closed end loan disclosures

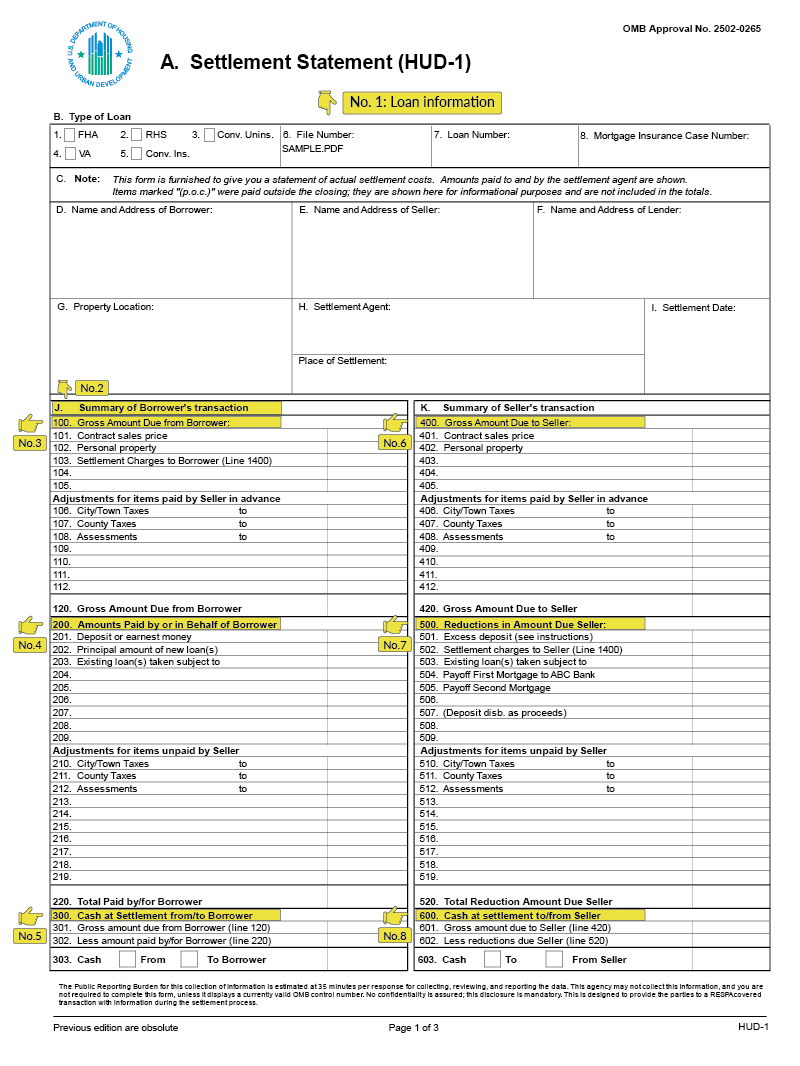

Prepared by Marjorie A. While some states have laws requiring the use of a state promulgated form in cash transactions in general the HUD-1 the Closing Disclosure or any other settlement statement can be used in cash transactions.

Understanding The Hud 1 Settlement Statement Lendingtree

Subpart AProvides general information that applies to both open-end and closed-end credit.

. This requirement is only applicable to first. A licensee under the. Is this treated like a construction loan even though real estate is not involved.

The disclosure rules of Regulation Z differ depend ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages. In addition federally related mortgage loans generally exclude temporary financing and construction loans. The value of a closed-end credit APR must be disclosed as a single rate only whether the loan has a single interest rate a variable interest rate a discounted variable interest rate or graduated payments based on separate interest rates step rates and it.

2018 Delaware Code Title 6 - Commerce and Trade CHAPTER 43. They would like to set it up on a 2year multiple advice loan and pay interest payments only. 3 The amount of any payment.

For closed end dwelling-secured loans subject to. For a closed-end credit transaction subject to 102619e and f opens new window real property or a cooperative unit does the credit union provide disclosures required under 102637 opens new window Loan Estimate and. If a closed-end credit transaction is converted to an open-end credit account under a written agreement with the consumer account-opening disclosures under 10266 must be given before the consumer becomes obligated on the open-end credit plan.

Open-end loans with an aggregate. Stating No downpayment does not trigger additional disclosures. See the commentary to 102617 on converting open-end credit to closed.

The Credit Union will provide closed-end disclosures that will include the following information. Only applies to purchase-money loans subject to RESPA. 22619a1 and 22619a2 10.

1 The amount or percentage of any downpayment. A refinancing takes place when an existing obligation is satisfied and. Depends on lien position.

Converting closed-end to open-end credit. We have a consumer who wants to set up a ClosedEnd Draw Note. Trigger terms when advertising a closed-end loan include.

Click hereto complete and print your Loan Application. There is no real estate or other collateral involved. 2 The number of payments or period of repayment.

Or 4 The amount of any finance charge. 102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling. Only applies to loans for the purpose of purchasing or initial construction of and secured by the consumers principal dwelling.

You and Your mean each and all of the applicants signing on the reverse You certify the accuracy of the information given in this application and you will notify the Credit Union in writing immediately if there is any. Calculation of amount financed APR finance charge security interest charges. 102637 Content of disclosures for certain mortgage transactions Loan Estimate.

If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance with 102637c and 102638c as required by 102619e and f. Alaska Small Loans Act. Closed-End Loan Disclosures for Skip a Payment Regulation Z does not require subsequent disclosures for skip payments on closed-end loans.

The value of a closed-end credit APR must be disclosed as a single rate only whether the loan has a single interest rate a variable interest rate a discounted variable interest rate or graduated payments based on separate interest rates step rates and it. Payment schedule including number amount and timing of payments. Description of the security interest if applicable.

Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers. What disclosures do we need in the Fed Box. 102638 Content of disclosures for certain mortgage transactions Closing Disclosure.

102635 Requirements for higher-priced mortgage loans. Regulation Z is structured accordingly. In most cases where a billingperiodic statement is generated for a closed-end loan the requirements for both the borrower and the lender are spelled out in the loan contract ie how many days before the payment due date will the lender mail the statement etc.

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written application and at least seven 7 business days before consummation. Please print review sign and return this Loan Disclosure Agreement with your Consumer Loan Application. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the.

Generally the only time that new Truth in Lending Act TILA disclosures are required for closed-end loans is if a refinancing occurs. Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 opens new window are subject to the disclosure timing and other requirements under the TILA-RESPA Integrated Disclosure rule TRID. Thus for most closed-end mortgages including construction-only loans and loans.

Of the disclosures you list here would be the status in a closed-end home equity loan. For a closed-end transaction secured by real property or a dwelling other than a transaction that is subject to 102619e and the creditor shall disclose a statement that there is no guarantee the consumer can refinance the transaction to. RISA governs closed-end financing of the retail sale of consumer goods valued at 25000 or less and partially governs.

Take A Look At The Altaone Specials For Rv Loans Are Those Lending Documents In Compliance Commercial Lending Credit Union Business Systems

Home Equity Oak Tree Business Home Equity Equity Mortgage Loans

Understanding Finance Charges For Closed End Credit

Home Equity Oak Tree Business Home Improvement Loans Refinance Mortgage Commercial Property

Truth In Lending Act Tila Consumer Rights Protections

Home Oak Tree Business Credit Union Fourth Of July Business Systems

What Is A Mortgage Closing Disclosure Nextadvisor With Time

Pin On Home Equity Lending For Credit Unions

Home Equity Oak Tree Business Home Equity Equity Line Of Credit

What Is A Closing Disclosure Finance Of America Mortgage

What Is A Closing Disclosure Finance Of America Mortgage

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

What Is A Closing Disclosure Finance Of America Mortgage

What Is A Closing Disclosure Quicken Loans

What Is A Closing Disclosure Finance Of America Mortgage

Home Buying Process Infographic Home Buying Process Home Buying Buying First Home

:max_bytes(150000):strip_icc()/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)